My 2024 Benefits

Your Medical Benefits

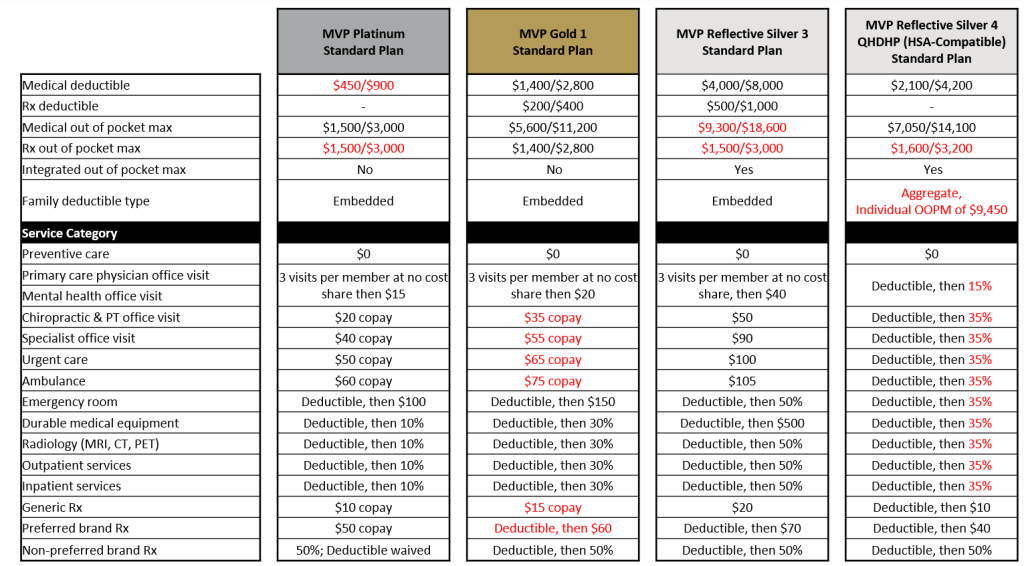

Brattleboro Savings & Loan offers 6 plans from MVP Healthcare

Standard Plans offered through MVP Healthcare

Standard Plans Summary of Benefits and Coverages (SBCs)

Standard Plans Slicks

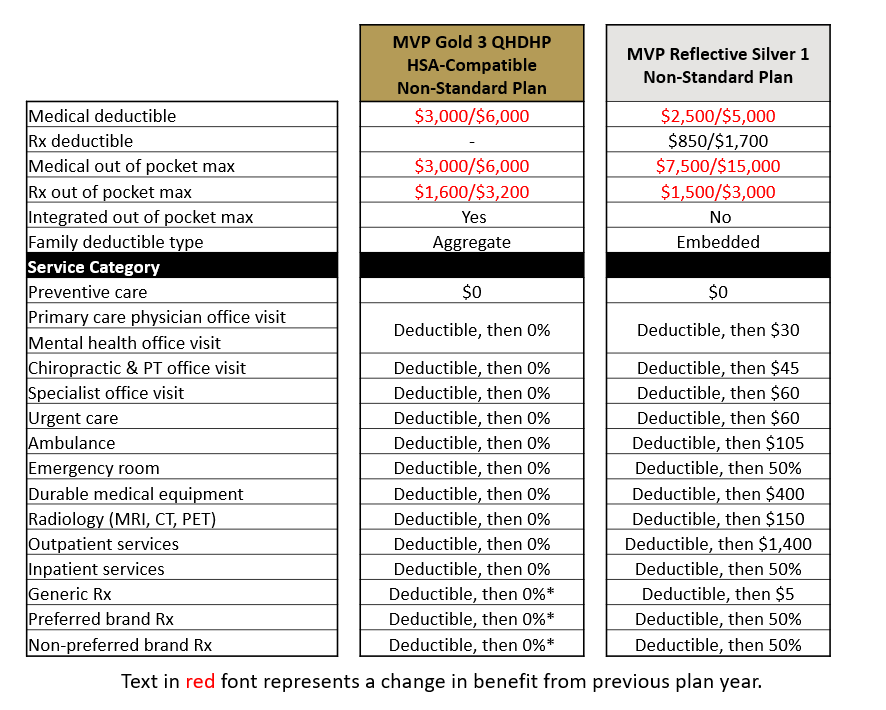

Non-Standard Plans offered through MVP Healthcare

Non-Standard Plans Summary of Benefits and Coverages (SBCs)

Non-Standard Plans Slicks

Wellness for Non-Standard Plans

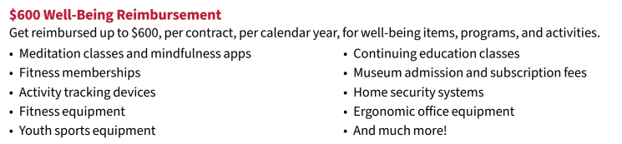

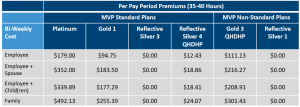

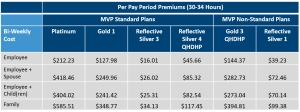

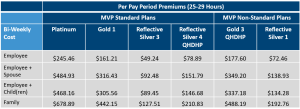

Contributions

Eligibility

All full-time employees who work at least 25 hours per week are eligible for coverage the first day of employment.

Contact Information

Phone – 800-229-5851

Website – www.mvphealthcare.com

Please click here for the MVP Provider Directory

Please click here for the MVP Formulary Drug List

Transparency in Coverage

By clicking on the button below, you will be led to the machine readable files that are made available in response to the federal Transparency in Coverage Rule and includes negotiated service rates and out-of-network allowed amounts between health plans and healthcare providers. The machine-readable files are formatted to allow researchers, regulators, and application developers to more easily access and analyze data.

Medical Coverage Documents

Your Health Savings Account and Dependent Care Account Benefits

Eligibility:

All full-time employees who work at least twenty five hours per week are eligible for coverage the first day of employment.

Health Savings Account (HSA)

The HSA allows you to contribute tax-free money into an account to be used to pay for qualified medical expenses.

Examples of Qualified HSA Expenses

- Hospital Services

- Ambulance

- Mental Health such Psychologist or Psychiatric Care

- Weight Loss Program

- Dental Treatment

- Hearing Aids

A full list of qualified expenses can be found here: https://www.healthequity.com/hsa-qme

Examples of Non-Qualified Expenses

- Cosmetic Surgery

- Controlled Substances

- Teeth Whitening

Contributions

For 2024, employees may make pre-tax contributions from their pay up to $4,150/Single and $8,300/Family. Individuals age 55 and older may contribute an annual catch-up contribution of $1,000.

Healthcare Reimbursement (FSA)

Annual Max & Utilization: The 2024 annual maximum amount you may contribute to an FSA is $3,200 in the calendar year. This program allows employees to use pre-tax dollars for certain IRS-approved expenses. Any unused FSA dollars will be forfeited in March, following the end of the plan year. *Over-the-counter medications are not reimbursable through the FSA unless you have a prescription from your physician.

Some examples include:

- Hearing services, including hearing aids and batteries

- Vision services, including contact lenses, contact lens

solution and eyeglasses - Dental services and orthodontia

- Medical and Rx deductibles; Co-payments and

Co-insurance

A full list of qualified expenses can be found here: https://healthequity.com/fsa-qme

Dependent Care FSA

The dependent care flex account allows you to reimburse yourself with pre-tax dollars for daycare

expenses for your children under age 13 and other qualified dependents. You can contribute up

to $5,000 per year; $2,500 if you and your spouse file your taxes separately.

Eligible Day Care Expenses:

- Childcare/Adult Care by a licensed childcare facility for children under age 13 who qualify as dependents on your federal income tax return

- Childcare/Adult Care for children or adult of any age who are physically or mentally unable to care for themselves and who qualify as dependents

Ineligible Day Care Expenses

- Child support payments

- Food, clothing and entertainment

- Educational supplies and activity fees

- Cleaning and cooking services not provided by the day care provider

- Overnight camp

For a full list of eligible expenses please click here: https://healthequity.com/dcfsa-qme

FSA/HSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Additional Information

Employee Advocate Services

Employee Advocate Services

As your employee benefits advisors, The Richards Group strives to ensure every employee understands their benefits and how to maximize their value. Our complimentary employee advocate services are confidential and designed to help you:

- Understand what’s covered on your plan and how much services will cost

- Search for high quality, in-network providers

- Navigate complex claims issues or concerns

- Interpret the insurance carriers’ Explanation of Benefits (EOBs)

Meet Chrissy!

Chrissy has worked in employee benefits for over 20 years. She understands the complex health care system, how insurance companies operate and the steps necessary to obtain a timely resolution to problems.

Reach out to Chrissy anytime, day or night via email at cfullam@therichardsgrp.com or by calling (603) 508-0549

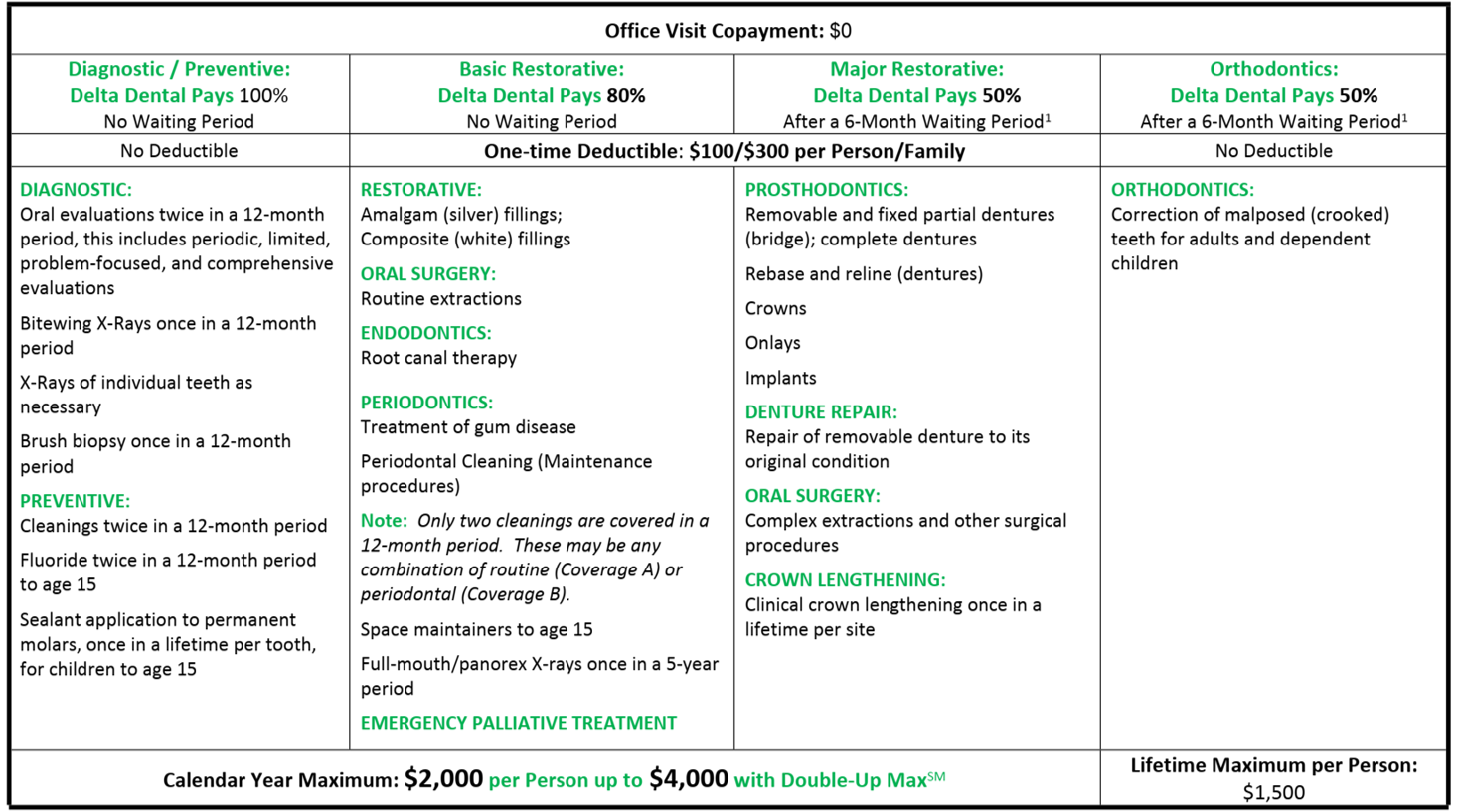

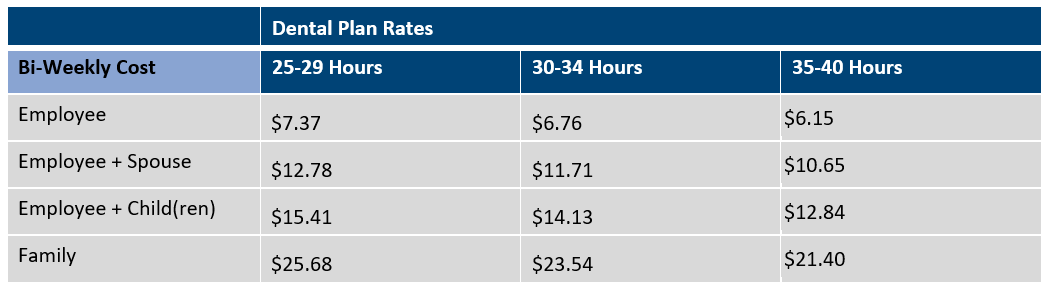

Your Dental Benefits

Your Vision Benefits

Vision Coverage provided through Vision Service Plan (VSP)

- Eyeconic®: –VSP’s online eyewear store, which offers an improved option for members, and non-members, who prefer to shop online for eyewear or contact lenses. Members can apply their VSP benefits directly to their purchase for glasses, sunglasses, and contacts, with the option to have their eyewear order shipped directly to their home or to a VSP practice. Visit Eyeconic® today at http://www.eyeconic.com/

- Extra $20 to spend on featured frame brands like bebe®, ck Calvin Klein, Flexon®, Lacoste, Nike, Nine West, and other select frames. At no cost to you, the extra $20 is automatically applied by the VSP doctor. No cost. No hassle. Just great choice and value. (not available at Walmart, Sam’s Club and Costco)

- Contact Lens Rebates: Visit the contact lens rebate section of our website to get up to $200 rebate on a an annual supply of eligible contacts from Bausch + Lomb, and there are also rebates for CooperVision lenses.

- TruHearing Hearing Aid Discount Program: VSP members receive FREE access ($108 value) and savings up to 50% on state-of-the-art digital hearing aids. This program is also available to VSP members’ dependents and extended family members!

- Free Eyewear Protection Program: As an exclusive benefit to members receiving services from a practice participating in the Premier Program (as indicated on vsp.com), they are eligible for free 12 month Eyewear protection when purchasing a featured frame brand. The Eyewear Protection Program is a worry-free warranty that replaces a VSP member’s Marchon/Altair featured frame brand frame, free of charge, if accidently broken or damaged for up to 12 months from purchase.

- Primary Eyecare is included with your plan for no additional premium, and can be used for Emergency Eyecare and Diabetic Eyecare. VSP doctors can diagnose and often treat urgent or chronic medical eye conditions, such as pink eye or eye injury. This can mean huge cost-savings over emergency rooms, urgent care centers or visits to a primary care physician. It also covers routine diabetic eye exams, and diabetic patients get a digital retinal examination covered in full instead of the $39 copay.

Eligibility:

All full-time employees who work at least 25 hours per week are eligible for coverage the first day of employment.

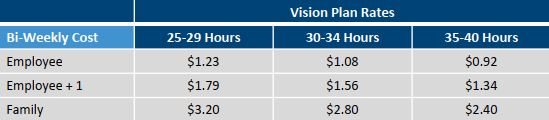

Contributions

Your Group Life Benefits

Group Life Insurance provided by Reliance Standard.

Eligibility:

All full-time employees who work at least 25 hours per week are eligible for coverage the first day of employment.

Benefit Overview

- Coverage is 1x annual salary to a maximum of $200,000, with a minimum of $15,000.

- AD&D is equal to the life benefit amount.

- Benefits reduce 50% at age 70.

- Benefits terminate at retirement.

Contributions

This is 100% Employer paid.

Plan Documents & Forms

Additional Information

Your Short and Long Term Disability Benefits

*NEW* Long Term & Short Term Disability is provided through Reliance Standard. Policy Period is 6/1/2021 – 12/31/2022

Eligibility:

All full-time employees who work at least 25 hours per week are eligible for coverage the first day of employment.

Short Term Disability

- Benefit is 66.67% of your basic weekly earnings, up to a maximum benefit of $2,500 per week.

- Benefits will be paid up to 26 weeks maximum for one period of disability.

- Benefits begin on the 1st day for disability due to an accidental injury.

- Benefits begin on the 8th consecutive day of illness for disability due to sickness.

- Benefits terminate at retirement.

Long Term Disability

- Benefit is 66.67% of pre-disability earnings to a maximum of $10,000 per month.

- Employees must be disabled for 180 consecutive days before benefits are paid.

- Benefits terminate at retirement.

Your Voluntary Life and AD&D Benefits

Voluntary Life Benefits are provided through Reliance Standard.

Voluntary Life Insurance

- Employees may choose to purchase additional life insurance from a minimum of $10,000 to a maximum of $500,000 in $10,000 increments.

- If you enroll in this benefit when first eligible, evidence of insurability is not needed for the first $100,000 elected, otherwise certain requirements will need to be met.

- Benefits reduce to 50% at age 70.

Voluntary AD&D Insurance

- Employees may choose to purchase additional accidental death & dismemberment insurance from a minimum of $10,000 to a maximum of $500,000 in $10,000 increments. (not to exceed 10x earnings for amounts over $250,000)

- Benefits reduce to 50% at age 70.

Spouse Voluntary Life Insurance

- Employees may choose to purchase additional life insurance for their spouse from a minimum of $5,000 to a maximum of $150,000 in $5,000 increments. Spouse amount may not exceed 100% of employee amount.

- Employees must purchase voluntary life insurance on themselves to elect to purchase it on their spouse.

- If you enroll in this benefit when first eligible, evidence of insurability is not needed for the first $20,000 elected.

Spouse Voluntary AD&D Insurance

- Employees may choose to purchase additional accidental death and disability insurance for their spouse from a minimum of $5,000 to a maximum of $150,000 in $5,000 increments. (spouse amount may not exceed 50% of employee amount).

Child(ren) Voluntary Life Insurance

- Employees may purchase additional life insurance for eligible dependent children aged 14 days to 26 years up to $10,000.

- Employees must first elect voluntary coverage for themselves, before purchasing voluntary coverage for their child dependent.

Child(ren) Voluntary AD&D Insurance

- Employees may purchase additional accidental death and dismemberment insurance up to $10,000 for eligible dependent children up to age 26.

- Employees must first elect voluntary coverage for themselves, before purchasing voluntary coverage for their child dependent.

SmartConnect - Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link: https://gps.smartmatch.com/therichardsgroup

Additional Information

401(k) Retirement

Eligibility

Planning for retirement can make all the difference in creating a life you really look forward to. Chances are, you’re working steadily towards a few different financial goals, such as paying off a mortgage and securing your family’s future. While it’s understandable to prioritize more immediate milestones, it’s also a good idea to work retirement into your regular savings plan.

Brattleboro Savings & Loan has partnered with T.Rowe Price to provide you with this valuable 401(k) retirement savings plan as part of your benefits.

It’s easy to get started. Simply register your account and enroll by visiting www.rps.troweprice.com

Once registered and enrolled, you can take advantage of:

- Automatic payroll deductions

- Pre-tax contributions

- Roth contributions

- Catch-up contributions (50 and over)

- Compound earnings

- Potential for reduced taxes

- And more…

Employees become eligible to participate in the 401(k)-retirement plan on date of hire.

The Bank will match 100% up to 5% of employees’ contributions to their 401(k).

If you would like additional guidance on contribution levels and investments BS&L has a Wealth Management Team who is happy to help. Please reach out to them at: (802) 257-7766.

Plan Information

Planning for retirement can make all the difference in creating a life you really look forward to. Chances are, you’re working steadily towards a few different financial goals, such as paying off a mortgage and securing your family’s future. While it’s understandable to prioritize more immediate milestones, it’s also a good idea to work retirement into your regular savings plan.

Brattleboro Savings & Loan has partnered with John Hancock to provide you with this valuable 401(k) retirement savings plan as part of your benefits.

New in 2023! Brattleboro Savings & Loan will match 100% up to 5% of employees’ contributions to their 401(k).

It’s easy to get started. Simply register your account and enroll by visiting myplan.johnhancock.com

Once registered and enrolled, you can take advantage of:

- Automatic payroll deductions

- Pre-tax contributions

- Roth contributions

- Catch-up contributions (50 and over)

- Compound earnings

- Potential for reduced taxes

- And more…

Contact Information

Your Additional Benefits

Invest EAP- Your Local EAP

Brattleboro Savings & Loan is pleased to offer employees a local, free, independent employee assistance program (EAP) to support you and your household members.

No one is immune from life’s challenges. Family dynamics, worries over the lingering virus, money, work/life balance, substance abuse: you name it, Invest EAP helps with it.

Invest EAP is a confidential clinical and wellbeing non-profit with a signature personalized approach to providing counseling and resources to your entire household. No problem is too big or too small.

EAP with Reliance Standard – ACI Specialty Benefits

An additional Employee Assistance Program (EAP) is offered to all Brattleboro Savings & Loan employees and immediate family members through ACI Specialty Benefits. This is a completely confidential counseling program that covers issues such as marital and family concerns, depression, substance abuse, grief and loss, child or elder care referrals, legal consultations, financial assistance or other personal stressors.

You can contact the Employee Assistance Program (EAP) via phone at 855-775-4357 or online at www.rsli.acieap.com

EAP Contact Information

Invest EAP: Employee Assistance Program

Phone#: 866-660-9533

Website: www.investeap.org

Password: bsal

Additional EAP Contact Information

ACI Specialty Benefits: Employee Assistance Program

Phone#: 855-775-4357

Website: www.rsli.acieap.com